OUR PROCESS

Common Challenges Employers Face Today

Attracting Talent

Employers struggle to attract top talent due to the competitive job market, evolving workforce expectations, and the need for a strong employer brand that resonates with potential hires.

Employee Retention

Retaining employees is challenging due to high turnover costs, the necessity of maintaining high levels of employee engagement, and the importance of providing clear career development paths.

Maintaining Revenue

Maintaining revenue is difficult because of rising operational costs, economic fluctuations, and productivity losses stemming from issues like workplace absenteeism and low employee morale.

While others talk, we act. Our solutions are backed by scientific research and proven outcomes, ensuring tangible results for your organization. Thrive365 Direct proudly partners with industry leaders to deliver comprehensive healthcare solutions packaged for a brighter future.

PROGRAM QUALIFICATIONS

Minimum of 5 Employees

W2 Employees Working Full-Time(Average of 30 Hours per Week)

Company Owners Are Ineligible for the Plan

213d STRATEGY

With our 213d Strategy*, business owners can save on taxes by offering a wellness plan that qualifies for deductions under IRS guidelines for medical care expenses. This plan covers costs for diagnosing, treating, and preventing physical or mental health issues. Additionally, our Wholesale Strategy ensures that both employers and employees benefit from significant healthcare savings.

“amounts paid for the diagnosis, cure, mitigation or treatment of a disease, and for treatments affecting any part or function of the body.”

*Section 1.213-1(e)(1)(ii) of the Income Tax Regulations provides, in part, that the deduction for medical care expenses will be confined strictly to expenses incurred primarily for the prevention or alleviation of a physical or mental defect or illness.

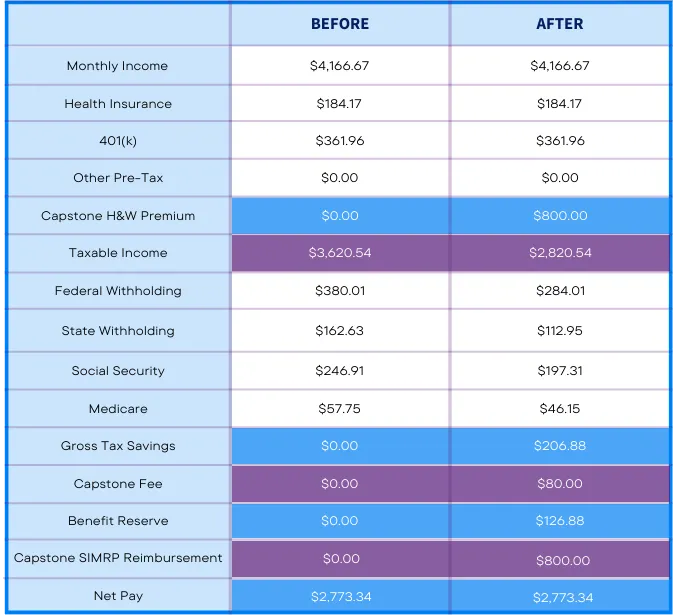

PAYCHECK EXAMPLE

• Monthly Gross Income Remains The Same

• All Pre-Tax deductions are unchanged

• This Plan is funded by a Section 125 premium deduction

• Taxable Income is reduced by $800 per month

• The participant received an increase of $206.88 due to the Capstone after-tax reimbursement

• The Capstone fee of $80 per month is deducted tax-free

• The Participant received $126.88 in Benefit Reserve to spend on voluntary benefits

• Take-home pay remains the same as before the Capstone Health & Wellness Plan

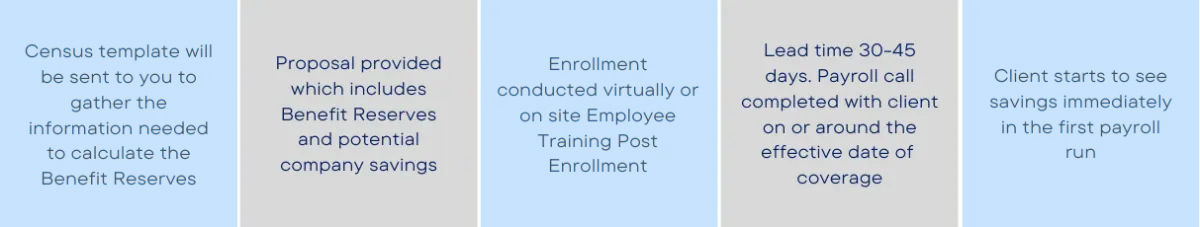

IMPLEMENTATION

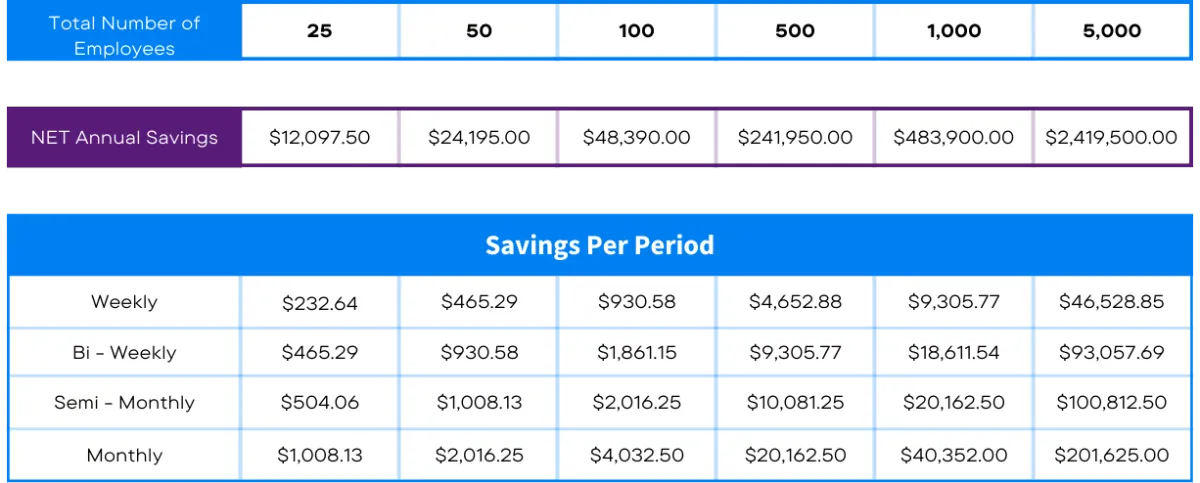

EMPLOYER SAVINGS EXAMPLE

Disclaimer: All 3 products and implementations may have different processes and implementations schedule, to be decided based on each group's customization.

KEY TAKEAWAYS

• Cafeteria plans, covered under section 125 of the Internal Revenue Code, allow employees to set aside pre-tax income for certain employer-offered benefits, such as wellness, adoption assistance, dependent care assistance, accident and health insurance, and group term life insurance policies, etc.

• Employers can save money by offering cafeteria plans to employees, as most plans are not subject to Medicare taxes and payroll taxes are generally lower.

• Employees have the advantage of choosing which programs to enroll in and which to decline to get the specific benefits that are most important to them.

• A Section 125 Cafeteria Plan should already be subtracted from the total amount of wages reported in box 1 on your W-2.

• Our Wholesale Strategy is built around this section of the IRS Code that allows a wellness plan to be deducted and reimbursed providing healthcare savings for both the Employer and Employee.

Drive to Thrive: Empower Your Health Journey Today!

A digital storefront for transformative business and insurance solutions, Hooba Health empowers individuals and organizations with comprehensive coverage options, ensuring they thrive in health and financial security.

All rights reserved by Hooba Health. Copyright 2025. Proprietary technology, process, and website designed by Shark Jockey.